Welcome to Davidson County

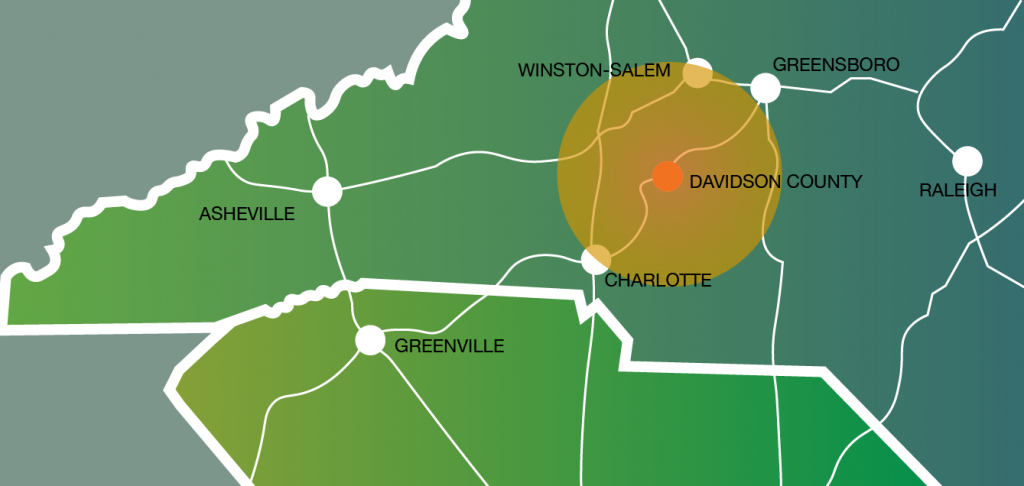

Located in the Piedmont region of central North Carolina, Davidson County is a vibrant area with a rich history and diverse economic opportunities for companies looking to expand their operations. Anchored by its great location, infrastructure, natural resources, and low taxes, Davidson County is home to several business ranging across various sectors such as manufacturing, healthcare, and tourism. This coupled with an abundance of recreational activities and housing makes Davidson County the ideal place to work, live, and play.

Davidson County Economic Development Mission Statement…

“Through a collaborative effort that is inclusive of local governments in the county; it is the mission of the DCEDC to create a business-friendly climate to foster growth of existing industries and to recruit new businesses to Davidson County. These efforts will facilitate broad, sustained economic growth through better careers and enhanced quality of life for the residents of Davidson County.”

Davidson County EDC is passionate about assisting businesses and our community. Our team of economic development experts helps companies who are expanding or relocating, assists communities in achieving their economic development goals, and supports measures to improve the quality of life for all Davidson County citizens.